WHAT WE DO

Driving unparalleled growth and innovation across global markets and asset classes. We are driven by a single purpose - Using macro analytics, applied mathematics, econometrics, statistical modelling and price action to yield ‘adaptive alpha’

At GeniusCrest, we believe that to be successful in investing; what is measurable is reliable. Thus, we augment quantitative and fundamental research along with Predictive Analytics & Behavioural Analytics to understand the DNA of markets.

We design algorithms and builds trading solutions. Our quantitative expertise combined with a sophisticated understanding of derivatives and financial markets help to continue improving the robustness of our models by adding new patterns and predicative signals.

We provide clients with the opportunity to explore pioneering investment strategies and innovative products, designed to ensure a competitive advantage in the market:

GeniusCapital Investment Management

Innovative Propriety Trading & Funds Management

GeniusCapital Investment Management employs a diverse array of proprietary trading and investment strategies across a spectrum of asset classes and markets. These strategies are currently available for fund of funds, private equity, venture capital, and distributed finance. Depending on the specific trading or investment strategy adopted for a given fund or managed account, we may operate on a discretionary or systematic basis, or a combination of both.

GeniusHedge

Dynamic Quantamental Portfolios of Strategies

We deploy a diversified set of strategies to trade futures, options, equities, foreign exchange, fixed income and cryptocurrency products. We leverage out cutting-edge proprietary trading software and infrastructure to provide us with rapid, dependable, and scalable access to global markets, enabling us to adopt a diverse range of trading strategies.

Designed to generate Positive Returns across bull and bear markets. The idea was to make something that if executed in worst possible latency & slippage would still be viable, with bullet proof risk management, 4 independent fail safes, and minimal markets risk.

GeniusSigma Research

GeniusSigma Research Framework

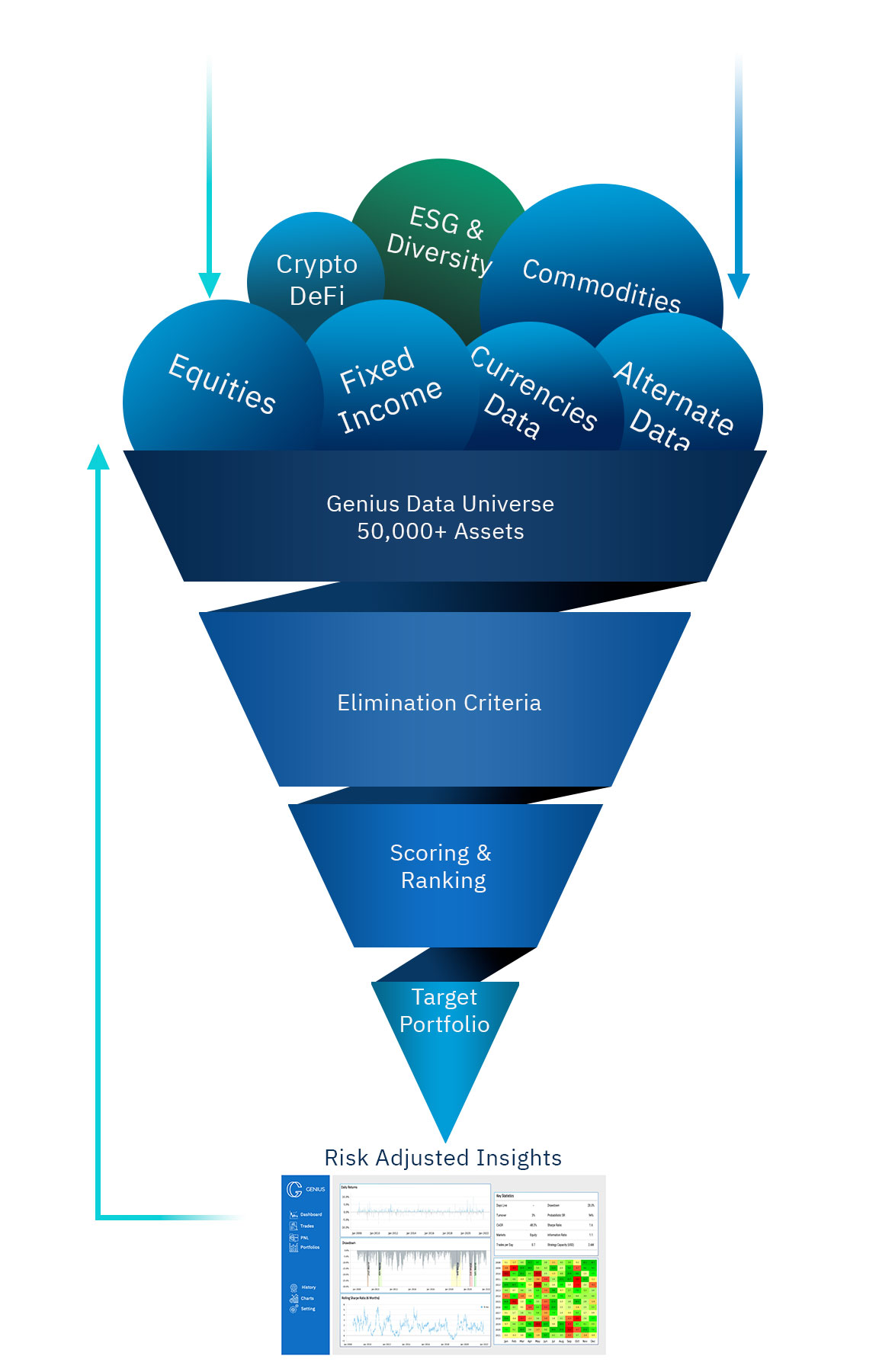

In order to understand the Investment Universe, GeniusSigma Research carries out an extensive and thorough process to take advantage of short-term and long-term opportunities.

We aim to capture substantial opportunities using quantitative, systematic predictive analytics for Investment Strategies for Portfolios & Trade Signals. We provide risk analysis, trading, and operational tools for investment and other financial industries.

Systematically Applied

A disciplined quantifiable methodology based on a continuous process of design, test, refine, repeat.

Rule-Based Criteria

We use risk factors like sector/ asset constraints, rebalancing along with our understanding of complex mathematical models that price securities to help generate low risk alphas.

Fundamental Approach

We rely on sound economic theory and analysis using factors like Quality, Growth, Value to help us deliver long-term, repeatable results.

The Complexity behind the Simplicity